BONUS DEPRECIATION: STRATEGIC WINDOW REOPENS

We have some great news for all of our investors! Recent legislative updates bring bonus depreciation back into sharper focus for investors. But this isn’t just a tax perk—it’s a window to restructure how long-term holdings are underwritten.

KEY IMPLICATIONS FOR INVESTMENT STRATEGY

- 60% bonus depreciation phase-in reintroduces aggressive cost recovery timing

- Opportunity zones and 1031 exchanges can now be re-optimized in parallel

- Real estate sponsors should reassess capital stack timing

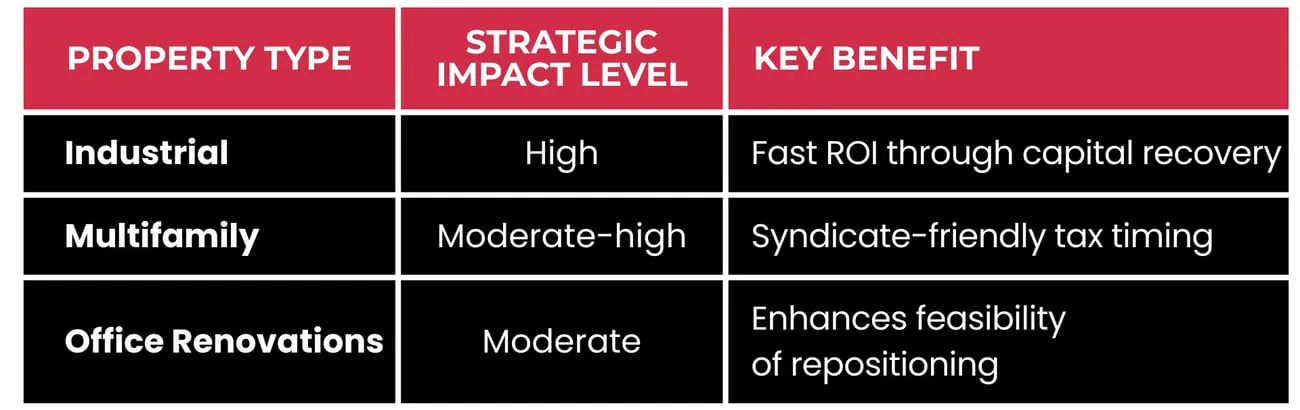

RANK OR WEIGHT THE BENEFIT

Use qualitative ranking or strategic weight to highlight where the depreciation matters most:

Bonus depreciation may reduce holding cost assumptions. Sophisticated underwriting teams should revisit amortization schedules.

MULTIFAMILY ECONOMIES OF SCALE

Scale isn’t just about unit count. Sapphire Partners outlines how operating efficiencies and backend tech deployment are producing better-than-expected margins—even in slower rent environments.

Strategic Levers In Scaled Portfolio

- Centralized leasing and digital tenant services

- Maintenance automation (predictive over reactive)

- Data-informed asset management across submarkets

Institutional capital is favoring sponsors with proven operating scale—not just acquisition prowess.

Market cycles and regulatory changes rarely move in sync, which is why disciplined strategy is key. Our research team will continue highlighting opportunities where risk-adjusted returns can be maximized.

If you’d like a deeper discussion on how these insights fit into your portfolio strategy, we’re here to connect!