SMART TENANT SCREENING: STAY COMPLIANT IN 2025

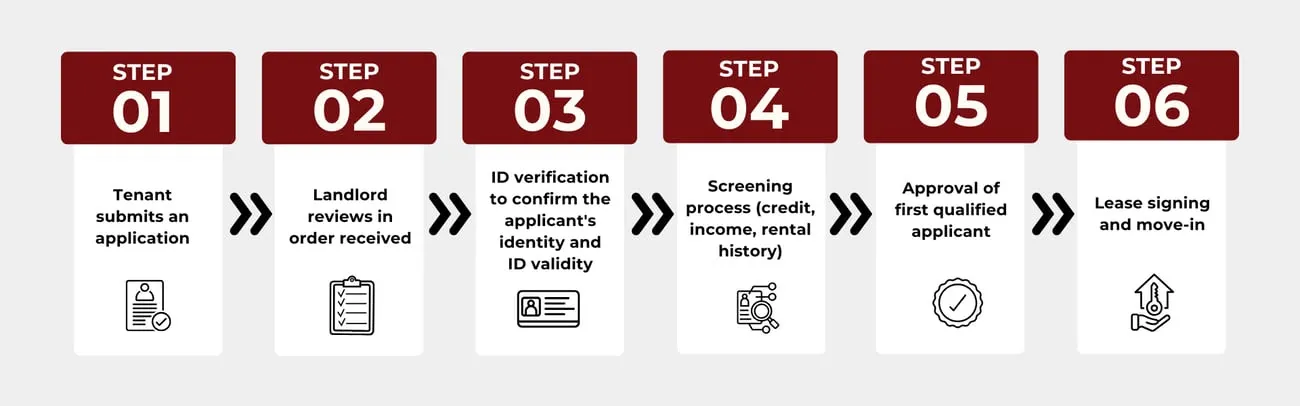

Finding a reliable tenant is one of the most crucial steps in protecting your rental investment, but new California laws have changed how landlords can charge and process application fees. Under Civil Code 1950.6, landlords must ensure transparency, fairness, and compliance in their screening process. Here’s what you need to know:

✅ Only Charge Fees When a Unit Is Available

If there’s no rental unit available or won’t be soon, charging a screening fee is prohibited.

✅ Process Applications in Order

Landlords must review applications on a first-come, first-served basis and approve the first qualified applicant.

✅ Refund Fees When Necessary

If an applicant isn’t selected, screening fees must be refunded within 7 days of leasing to another tenant or within 30 days if no decision is made.

✅ Disclose Screening Criteria Upfront

Clearly state your rental requirements in writing before accepting fees to ensure fair and consistent evaluations.

✅ More Than Just Credit Scores

While a good credit score helps, other factors—like income verification, rental history, and background checks—play a key role in selecting the right tenant.

A thorough tenant screening process is essential for protecting your investment. It helps identify responsible tenants, reduces the risk of late payments, property damage, and costly evictions, and ensures a stress-free rental experience. At Power Property Management, we handle everything—from background checks and credit reports to rental history verification—so you don’t have to. Our expert team ensures full compliance with all regulations and a seamless leasing process.

Ready to secure high-quality tenants and maximize your rental income? Contact us today!

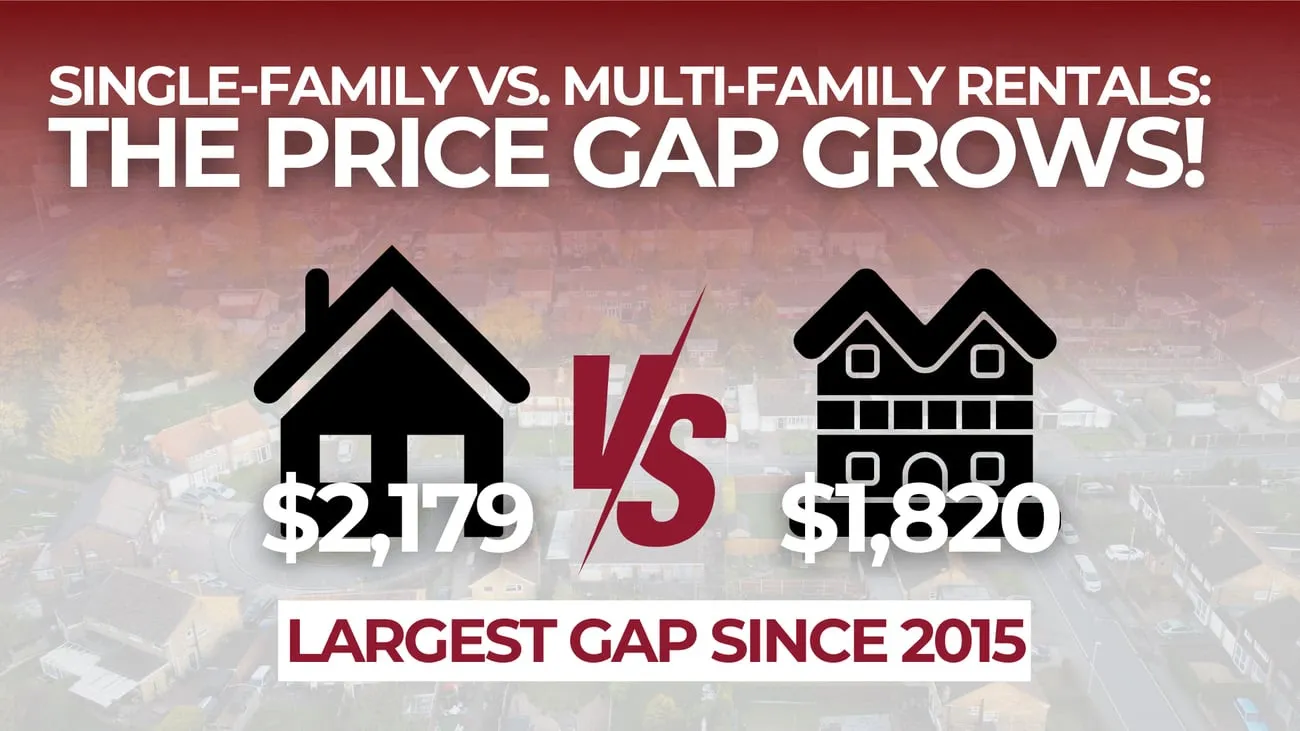

The rental market is shifting, and it’s important for property owners to stay ahead. While multi-family rents are stabilizing due to new construction, single-family rentals are in high demand, keeping prices elevated. Here’s what’s happening:

✅ Single-family rentals remain in demand

Limited new construction has kept supply low, driving higher rental prices.

✅ Rent prices continue to climb

Single-family rental prices are up 41% since pre-pandemic levels, compared to a 26% increase for multi-family units.

✅ Millennials are renting longer

With homeownership out of reach for many, more families are seeking larger rental properties.

✅ The rent gap is at an all-time high

Single-family rentals now command a record premium over multi-family units.

✅ Creditworthiness is key

Renters looking for single-family homes need strong financials, making thorough tenant screening more important than ever.

For property owners, understanding these trends can help maximize returns. If you’re considering expanding your portfolio or adjusting rental strategies, now is the time to act.