Stay Informed: Los Angeles Property Management June 2025 Updates!

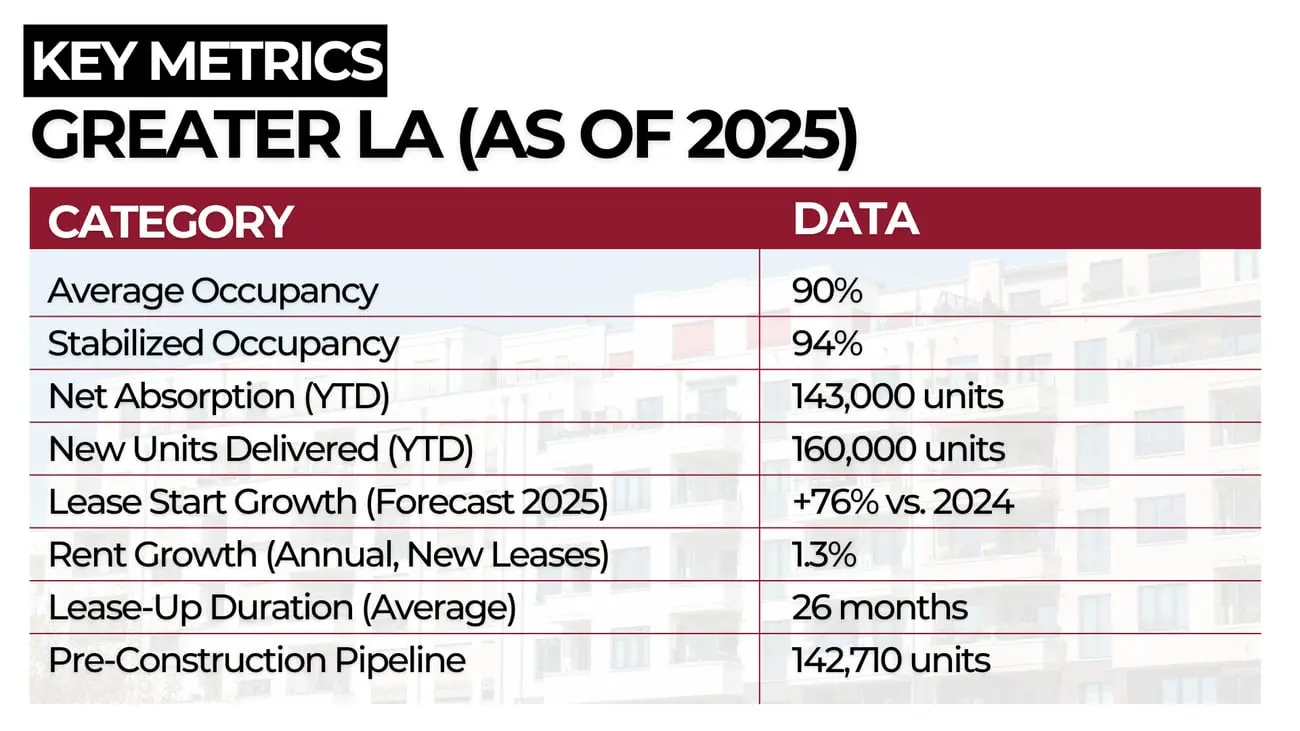

So far in 2025, more units are hitting the LA market than are being absorbed. Occupancy is holding, but rent growth is soft and lease-up times are stretching. Owners should keep a close eye on demand by submarket.

What This Means for Property Owners

- Leases may take longer.

Supply is still outpacing demand, especially in high-build areas. - Renters expect incentives.

Even with fewer concessions, they still play a role in closing deals. - Rent growth varies.

Some areas are stable; others are flat. Raising rents too fast could increase vacancy. - Lease-ups are slower.

New units now take longer to fill. Plan for extended timelines.

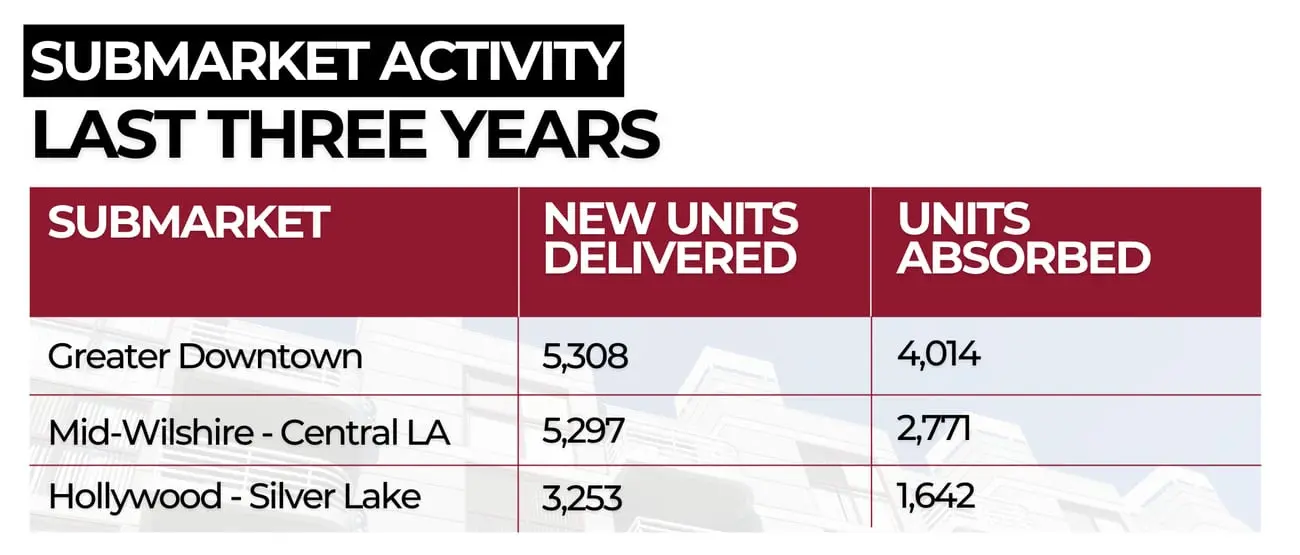

These areas are leading in both development and demand — but still show a gap between supply and leasing.

Key Takeaways

- Vacancy risk is rising in overbuilt areas.

- Rent growth is modest, driven by only a few high-performing submarkets.

- Longer lease-up cycles mean slower ROI for new units.

Submarket-level decisions matter more than ever. Pricing, timing, and tenant retention will define performance this year.

We’ll keep you updated as new data comes in.

We’ve recently added several new buildings to our management portfolio—an ongoing reminder that owners value experienced, dependable support. If staying ahead in property management is part of your plan, we’d love to connect!