Stay Informed: February 2026 Investor Update

As 2026 progresses, the multifamily market is entering a more balanced phase where fundamentals and execution matter most.

This update includes an important announcement regarding DB Invest’s merger into Power Capital Group, along with insights on continued market normalization, a spotlight on Denton, Texas, and key insurance risks investors should be aware of as operating conditions evolve.

Power Capital Group is excited to announce the official merger of DB Invest into PCG. After seven years of partnership between Power Capital Group and DB Invest, this strategic move further strengthens our platform and enhances our ability to serve investors and partners as we continue to expand our multifamily presence.

As we begin this next chapter, we welcome Ethan Diaz to Power Capital Group as Managing Partner & Asset Manager, where he will support the ongoing management and execution of our portfolio as we continue to move forward.

The multifamily housing market continues its gradual normalization. While transaction volume remains selective, well-positioned assets in markets with durable demand are performing as expected. Key themes shaping the current environment include:

- 📈 Demand Stability: Employment-driven rental demand remains resilient, particularly in secondary and tertiary markets.

- 🏗️ Supply Discipline: New construction has slowed meaningfully, easing pressure on rent growth and occupancy.

- ⚙️ Operational Focus: Operators emphasizing expense control and resident retention are outperforming broader averages.

For investors, this reinforces the value of patience, strong reserves, and long-term positioning rather than short-term speculation.

Denton continues to benefit from strong population growth, proximity to the Dallas–Fort Worth metroplex, and a diversified employment base anchored by education and healthcare.

Key Strengths Include:

Rental demand is supported by a large student population and a growing workforce base, creating steady absorption across both academic and employment-driven housing segments.

Development is constrained by limited infill availability and zoning restrictions, which naturally caps new supply and reduces the risk of oversaturation in the market.

Relative affordability compared to surrounding metros continues to attract renters priced out of nearby markets, supporting sustained demand over the long term.

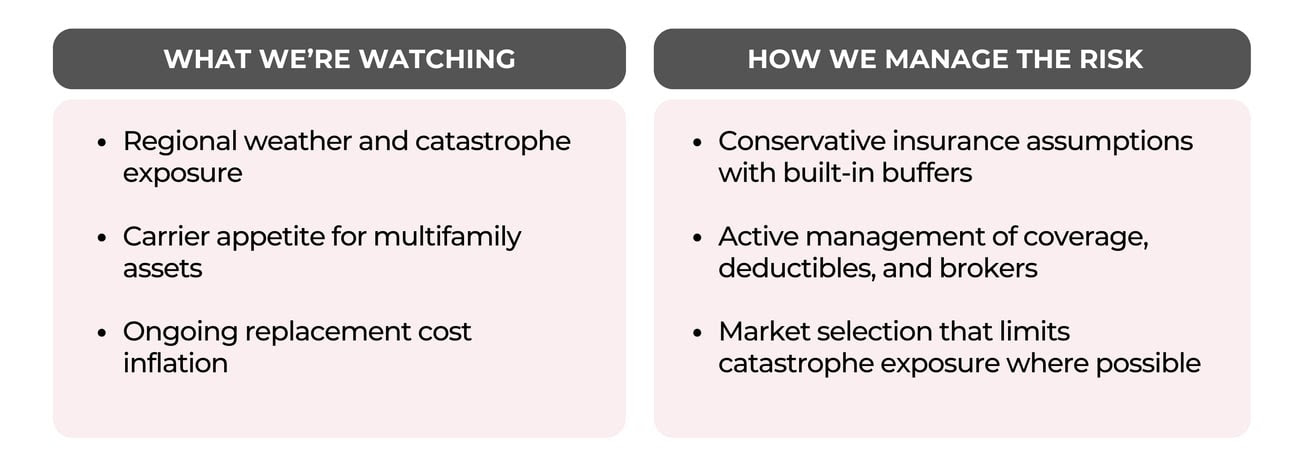

Insurance remains one of the most significant and least controllable expenses in real estate underwriting. In 2026, rate pressure and market volatility continue to vary by region, driven by catastrophe exposure, carrier capacity, and replacement cost inflation.

Because insurance directly impacts operating expenses, unexpected increases can pressure NOI, affect distributions, and influence refinancing assumptions.

While insurance markets remain dynamic, disciplined underwriting and proactive planning help protect cash flow and long-term performance.