2026 Housing Snapshot: A Market in Transition

As we begin 2026, we are assessing current market conditions, highlighting the stability of the Texas multifamily market, and outlining how investment decisions are being guided in the year ahead.

These updates reflect Power Capital Group’s continued focus on fundamentals, risk management, and long-term value creation.

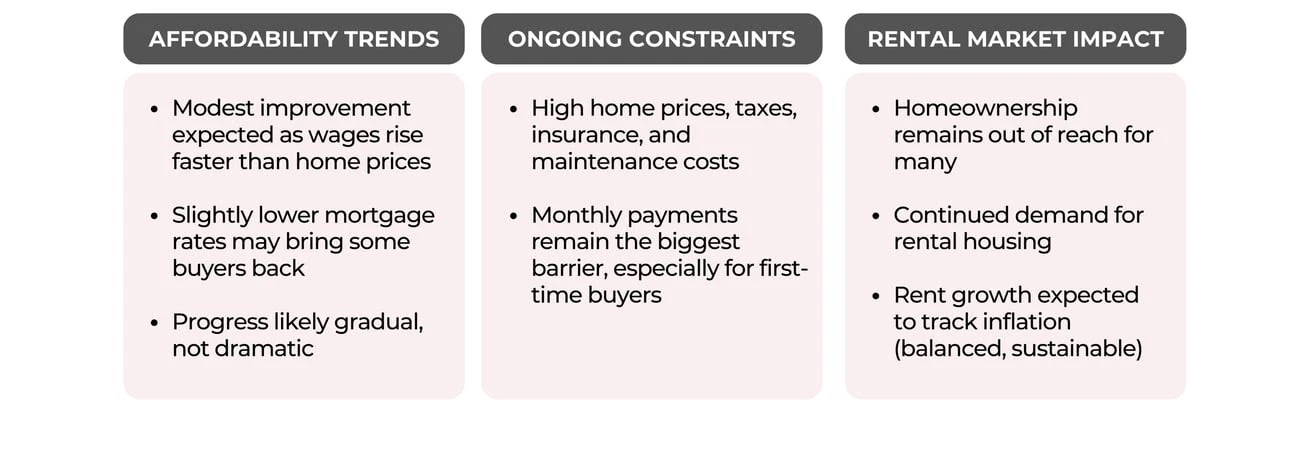

The housing market enters 2026 in a period of gradual adjustment rather than rapid change.

For investors, 2026 is a transitional year. Markets with strong employment, limited new supply, and durable demand are best positioned to perform. Conservative underwriting, disciplined operations, and a focus on cash-flow stability are likely to outperform speculative growth strategies as the market normalizes

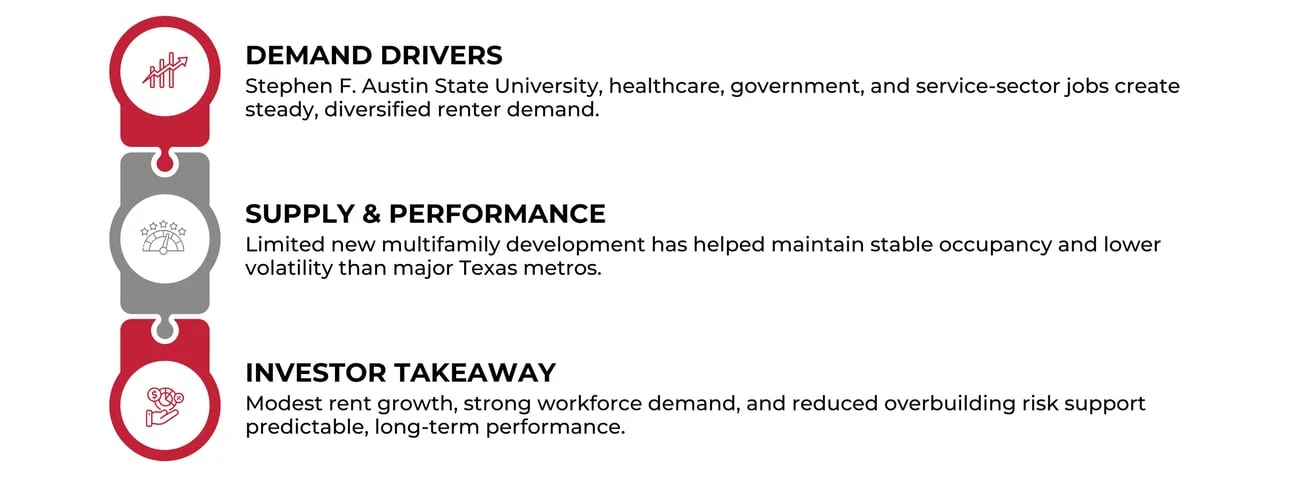

Market Spotlight Nacogdoches Multifamily Built on Strong Local Fundamentals

Nacogdoches is a smaller, demand-driven market supported by consistent local fundamentals and limited new supply, creating a stable environment for long-term multifamily investment.

As markets normalize, Nacogdoches stands out for its steady demand and lower exposure to supply-driven risk.

Setting the Tone for 2026: Focused Execution in a Normalizing Market

As we enter the first quarter of 2026, the emphasis remains on consistent execution across the portfolio. With market conditions continuing to normalize, proactive asset management and thoughtful capital planning are essential to protecting investor capital and supporting long-term performance.

Long-term trends continue to support rental housing, as younger generations rent longer and delay homeownership, sustaining demand for well-located, professionally managed communities. At the same time, other real estate sectors, particularly commercial office, continue to face challenges, reinforcing the importance of selectivity and strong asset-level oversight.

By prioritizing conservative underwriting, strong reserves, and early investment in property improvements, operational risk is reduced while assets are positioned for steady cash flow and long-term value.

Entering 2026, the strategy is clear: prioritize stability, remain selective, and execute with intention while keeping investor interests at the center of every decision.